Since 2013, health insurance companies and pharmacy benefit managers (PBMs) have shifted the cost of medicines to patients by increasing the use of deductibles and coinsurance.1 In 2021, not only did 2 out of every 3 commercially insured patients taking brand name medications fill a prescription in the deductible phase or with coinsurance, but patients who paid in the deductible phase faced costs that were on average nearly 8 times higher than patients who filled prescriptions with copays.2 The copay assistance support provided by pharmaceutical companies has been a critical tool in alleviating patients’ out-of-pocket (OOP) cost burden. Patients who used this assistance to access their medicines saved nearly $500 in 2021.2

However, insurance companies and PBMs (payers) have recently saturated the commercial health insurance market with programs that restrict copay assistance for brand name medications. One such program is a copay accumulator adjustment program. These programs prevent patients from realizing the benefit of copay assistance. Instead, payers take the value of the assistance and block those funds from counting toward patients’ deductibles and their OOP maximum under their health plan.

As a result, patients may exhaust the copay assistance funds well in advance of reaching their health plan OOP maximums. This results in patients having to pay significant OOP costs and potentially reducing adherence to a prescribed therapy. Recent research demonstrates that copay assistance can positively impact outcomes through treatment persistence and adherence.3 Eliminating the benefit through copay accumulator adjustment programs may cause the opposite effect through reduced fills and discontinuation of therapy.4,5

This issue brief analyzes the impact of copay accumulator adjustment programs on patient cost-sharing for select therapeutic areas, examines implications for affordability and adherence, and discusses policy solutions necessary to safeguard access.

How copay accumulator adjustment programs work

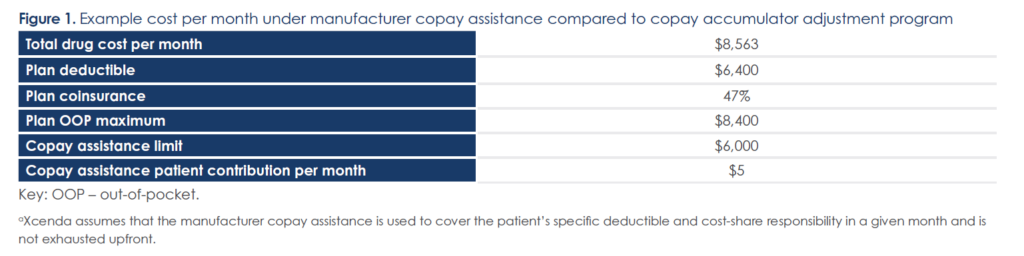

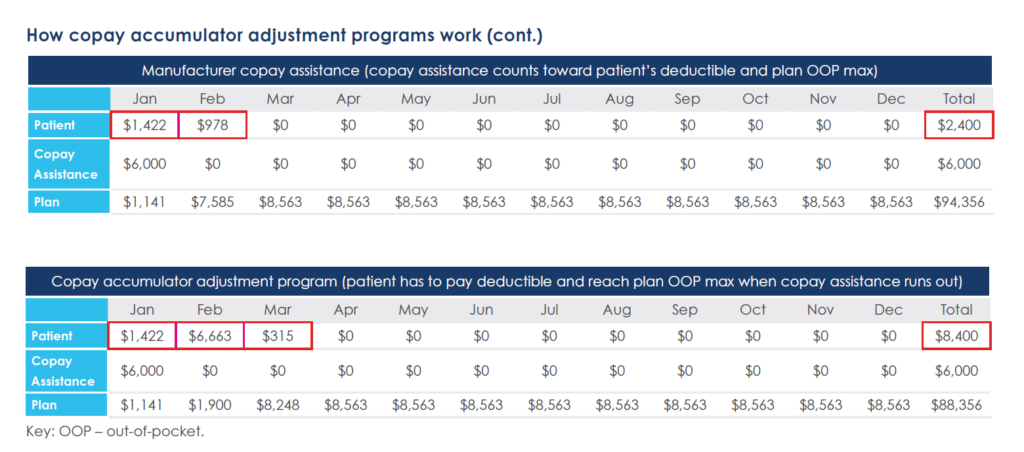

The example below depicts a patient’s journey on a therapy prescribed to treat rheumatoid arthritis (RA), assuming the patient has an annual manufacturer copay assistance limit of $6,000.a In this example, the patient incurs an additional $6,000 in OOP costs and begins to see costs rise in month 2 under a copay accumulator adjustment program relative to a scenario in which copay assistance is applied toward their deductible and plan OOP max (Figure 1). Costs incurred by the plan correspondingly decrease by $6,000.

Methodology

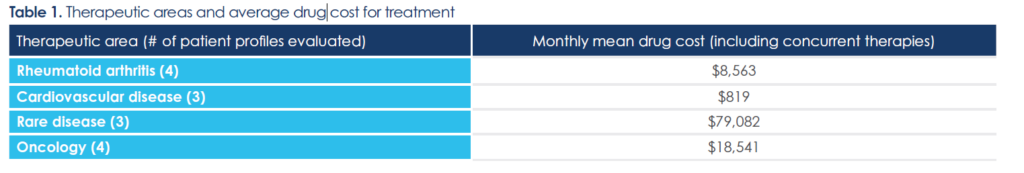

Xcenda examined and determined the quantifiable impact of copay accumulator adjustment programs on patients with chronic illnesses. To that end, Xcenda evaluated 4 therapeutic areas for which patients typically require treatment over an extended period (Table 1). To account for different price points for each therapeutic area, the total monthly drug cost was estimated by creating a representative patient profile for 3-4 target therapies per therapeutic area. The profiles accounted for use of other concurrent therapies.

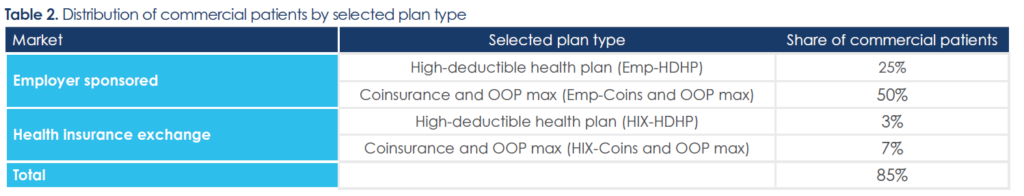

Since patient OOP costs can vary based on plan benefit parameters and design, Xcenda evaluated 2 employer-sponsored plan designs and 2 health insurance exchange plan designs (Table 2). The selected plan types allow for direct comparison of the costs incurred by patients enrolled in health insurance exchanges vs employer plans and collectively represent 85% of patients with commercial insurance nationally.6-8

Using the average monthly cost of treatment, Xcenda modeled patient OOP costs under manufacturer copay assistance vs a copay accumulator adjustment program for the selected plan benefit designs. To calculate OOP cost-share, plan-specific benefit parameters were applied, considering coinsurance, deductible, and annual plan OOP maximum and also assuming an annual manufacturer copay assistance limit by therapeutic area.b

b Since the target therapies included under each therapeutic area were sometimes subject to different manufacturer copay assistance limits, Xcenda employed the most conservative amount of manufacturer assistance by applying the lower annual assistance limit among the drugs in the therapeutic area.

Findings show that patients faced substantially higher OOP costs under a copay accumulator adjustment program relative to manufacturer copay assistance

Evaluating 4 therapeutic areas

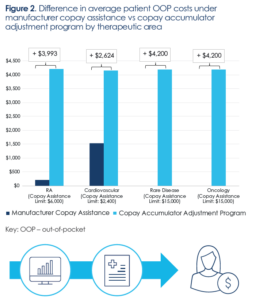

Averaging across plan types, under manufacturer copay assistance, patients faced varying OOP costs, ranging from $0 for both rare disease and oncology, $215 for RA, and $1,500 for cardiovascular disease.

For RA, rare disease, and oncology, annual patient OOP costs increased by about $4,000 under a copay accumulator adjustment program

The copay accumulator adjustment program scenario resulted in an increase of average OOP costs by about $4,000 to $4,200 relative to manufacturer copay assistance for 3 of the 4 therapeutic areas (Figure 2). Cardiovascular disease was associated with a smaller increase in average patient OOP costs (~$2,600) under the copay accumulator adjustment program due to a lower manufacturer copay assistance limit ($2,400) relative to other therapeutic areas ($6,000 and $15,000). As a result of the lower assistance limit, cardiovascular patients were exhausting manufacturer assistance and bearing meaningful financial burden even under copay assistance.

Higher patient OOP costs under copay accumulator adjustment programs correspondingly generate savings for payers. The findings suggest that with the use of copay accumulator adjustment programs, on average, payers reduce their liability by nearly $13,000 per patient for rare disease and oncology patients (−1% and −6%, respectively), by ~$5,100 (−5%) for RA patients, and by ~$2,600 (−45%) for cardiovascular patients.

Exchange plans vs employer plans subject to copay accumulator adjustment programs

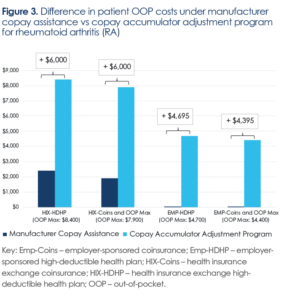

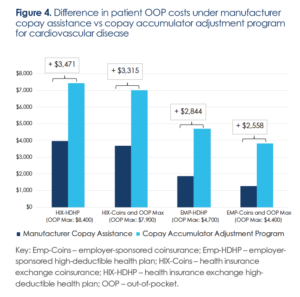

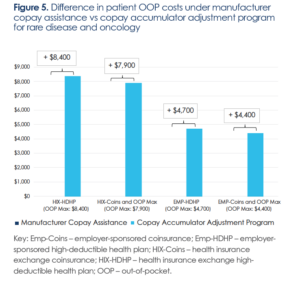

Across all therapeutic areas, the results suggest patients who obtain coverage through the health insurance exchange plans are likely to bear significantly higher cost burden under a copay accumulator adjustment program relative to patients with commercial employer insurance.

Figure 3 illustrates these cost burden findings for RA patients: Those with employer-sponsored plans had minimal OOP costs ($5) under copay assistance because the plan OOP maximums ($4,700 for the employer-sponsored high deductible plan and $4,400 for the employer sponsored coinsurance and OOP max plan) were well below the manufacturer copay assistance limit of $6,000. However, under the copay accumulator adjustment program, annual patient OOP costs for RA reached the OOP maximum for each respective employer plan.

Compared to employer plans, patients in health insurance exchange plans experienced a larger increase in OOP burden as a result of a copay accumulator adjustment program

For health insurance exchange plans, patients already incurred between $1,900 and $2,400 in OOP costs under copay assistance since the exchange plans’ OOP maximums were each higher than the RA manufacturer assistance limit. The copay accumulator adjustment program further exacerbated financial burden as OOP costs for patients in exchange plans increased by $6,000 to the respective plan OOP maximum ($8,400 for the health insurance exchange high-deductible plan and $7,900 for the health insurance exchange coinsurance and OOP max plan).

Federal policy action is necessary to counter the potentially detrimental impact of copay accumulator adjustment programs on patient affordability

Results

Demonstrated by this analysis, copay accumulator adjustment programs negate the intended benefit of manufacturer copay assistance and potentially remove a safety net for commercially insured patients who need brand name medications but cannot afford their OOP costs. These programs also disproportionally hurt the most vulnerable patients. A recent survey found that 69% of patients relying on copay assistance programs have incomes below $40,000 per year.9 The additional ~$4,000 in average annual OOP costs incurred under a copay accumulator adjustment program estimated by Xcenda’s analysis represents more than 10% of income for these patients. Additionally, patients who qualify for marketplace exchange plans have comparatively lower incomes and lack access to employer sponsored health insurance.10 Xcenda’s analysis found that patients in health exchange plans faced an even greater financial burden under copay accumulator adjustment programs.

Policy recommendations

To address this adverse impact on patients, both Congress and the Centers for Medicare & Medicaid Services (CMS) can take action to protect patients from these payer tactics.

• Congressional enactment of a ban on payer tactics to prevent programs and approaches that prevent the full benefit of copay assistance from counting toward a patient’s OOP cost calculation

• Prohibiting or limiting the use of these programs by CMS via the annual regulatory release of the Notice of Benefit and Payment Parameters rule

As of January 2023, laws in 16 states and Puerto Rico address the use of copay accumulator adjustment programs by insurers or PBMs by requiring any payment or discount made by or on behalf of the patient to be applied to a patient’s annual OOP cost-sharing requirement.11 However, many large, self-funded employer health insurance plans—administered by PBMs— are driving the use of copay accumulator adjustment programs, and these laws have a limited purview as those plans are governed under ERISA (the Employee Retirement Income Security Act of 1974) and are therefore exempt from state mandates. An enactment of a law banning these programs at the federal level would rectify this issue. Additionally, CMS has the authority to prohibit or limit the scope of these programs, as CMS opened the door for the programs in previous regulation from 2020.12

Safeguarding patient affordability and access to critical therapies is essential to improving health outcomes. Prohibiting accumulator adjustment programs will enable more disadvantaged patients to access life-saving medications.

Appendix: Results for additional therapeutic areas

References

References

1. Barnhill A, Ehrenberg R, Glass R. Understanding patient out-of-pocket: the impact of patient spending limits and senior savings plans. IQVIA.

White paper. October 2022. Accessed January 12, 2023. https://www.iqvia.com/-/media/iqvia/pdfs/us/white-paper/2022/understandingpatient-

out-of-pocket-impact-of-spending-limits.pdf

2. PhRMA. Deductibles and coinsurance drive high out-of-pocket costs for commercially insured patients taking brand medicines. November

2022. Accessed January 12, 2023. https://phrma.org/-/media/Project/PhRMA/PhRMA-Org/PhRMA-Refresh/Report-PDFs/G-I/IQVIA-Report-High-

OOP-for-Brand-Medicines_November-2022_v2.pdf

3. Parekh KD, Wong WB, Zullig LL. Impact of co-pay assistance on patient, clinical, and economic outcomes. Am J Manag Care.

2022;28(5):e189-e197. doi:10.37765/ajmc.2022.89151

4. IQVIA Institute. Medicine spending and affordability in the U.S. August 4, 2020. Accessed December 9, 2022. https://www.iqvia.com/-/media/iqvia/pdfs/institutereports/medicine-spending-and-affordability-in-the-united-states.pdf

5. Sherman BW, Epstein AJ, Meissner B, Mittal M. Impact of a co-pay accumulator adjustment program on specialty drug adherence. Am J

Manag Care. 2019;25(7):335-340. Accessed December 7, 2022. https://www.ajmc.com/view/impact-of-a-copay-accumulator-adjustmentprogram-

on-specialty-drug-adherence

6. Congressional Budget Office. Federal subsidies for health insurance coverage for people under age 65: tables from CBO’s July 2021 baseline.

July 2021. Accessed April 14, 2022. https://www.cbo.gov/system/files/2021-08/51298-2021-07-healthinsurance.pdf

7. Kaiser Family Foundation. 2022 marketplace plan selections by metal level. Accessed December 7, 2022. https://www.kff.org/bf599ef/

8. Kaiser Family Foundation. 2022 employer health benefits survey—summary of findings. October 27, 2022. Accessed December 7, 2022.

https://www.kff.org/health-costs/report/2022-employer-health-benefits-survey

9. National Hemophilia Foundation. Patients & family caregivers: prescription drug affordability challenges during COVID-19. April 29, 2021.

Accessed December 9, 2022. https://www.hemophilia.org/sites/default/files/document/file /NHF%20-%20National%20Patients%20and%20Caregivers%20Survey%20on%20Copay%20Assistance%20%28Key%20Findings%29.pdf

10. Kominski GF, Nonzee NJ, Sorensen A. The Affordable Care Act’s impacts on access to insurance and health care for low-income populations.

Annu Rev Public Health. 2017;38:489-505. doi:10.1146/annurev-publhealth-031816-044555

11. National Conference of State Legislatures. Copayment adjustment programs. February 1, 2022. Accessed March 6, 2022. https://www.ncsl.org/research/health/copayment-adjustment-programs.aspx

12. HHS notice of benefit and payment parameters for 2021. May 7, 2020. Accessed January 12, 2023. https://s3.amazonaws.com/publicinspection.federalregister.gov/2020-10045.pdf